SAP Employers with an Australian Payroll with 20 or more employees will need to start reporting through Single Touch Payroll (STP) by 30 April 2019.

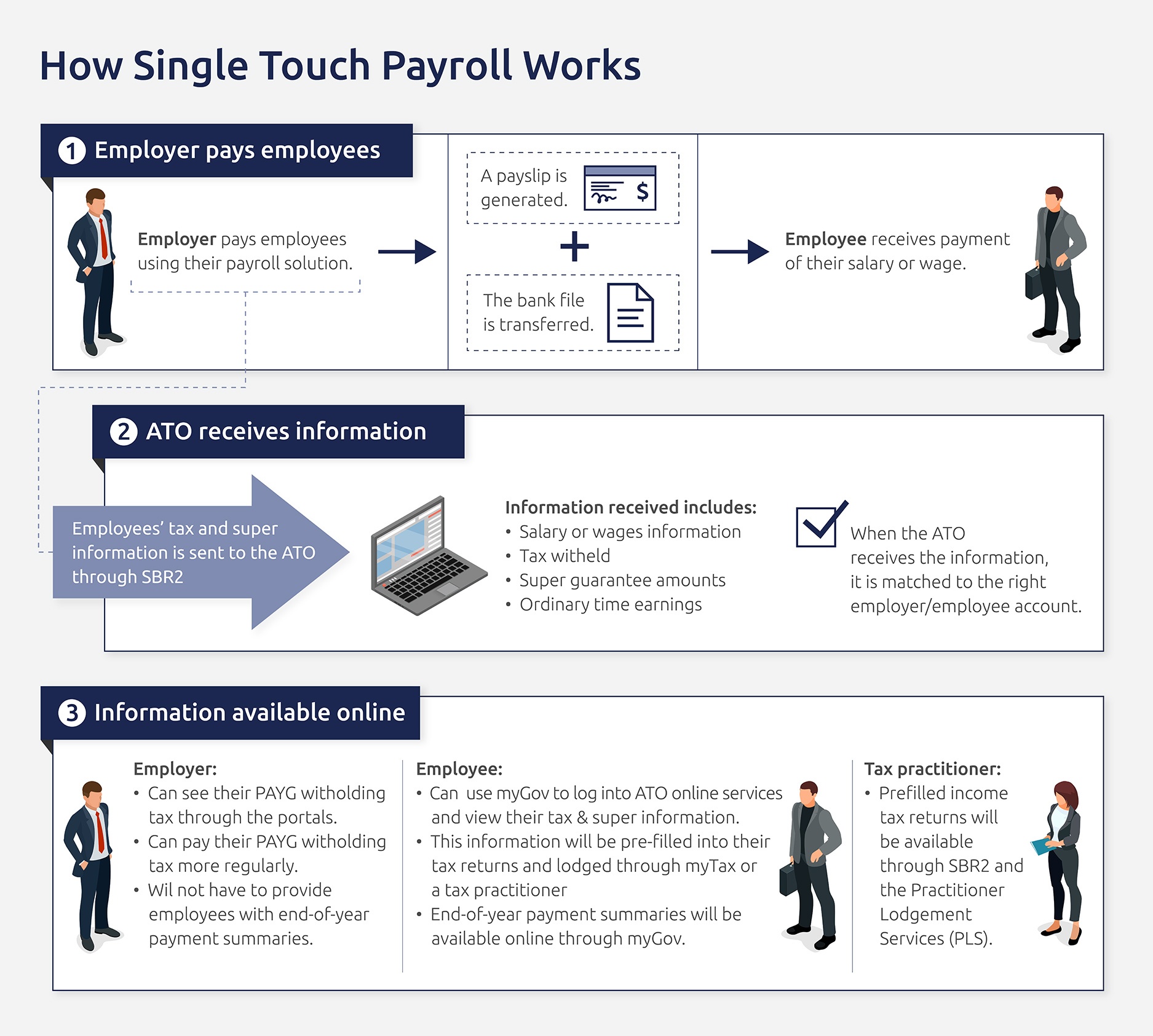

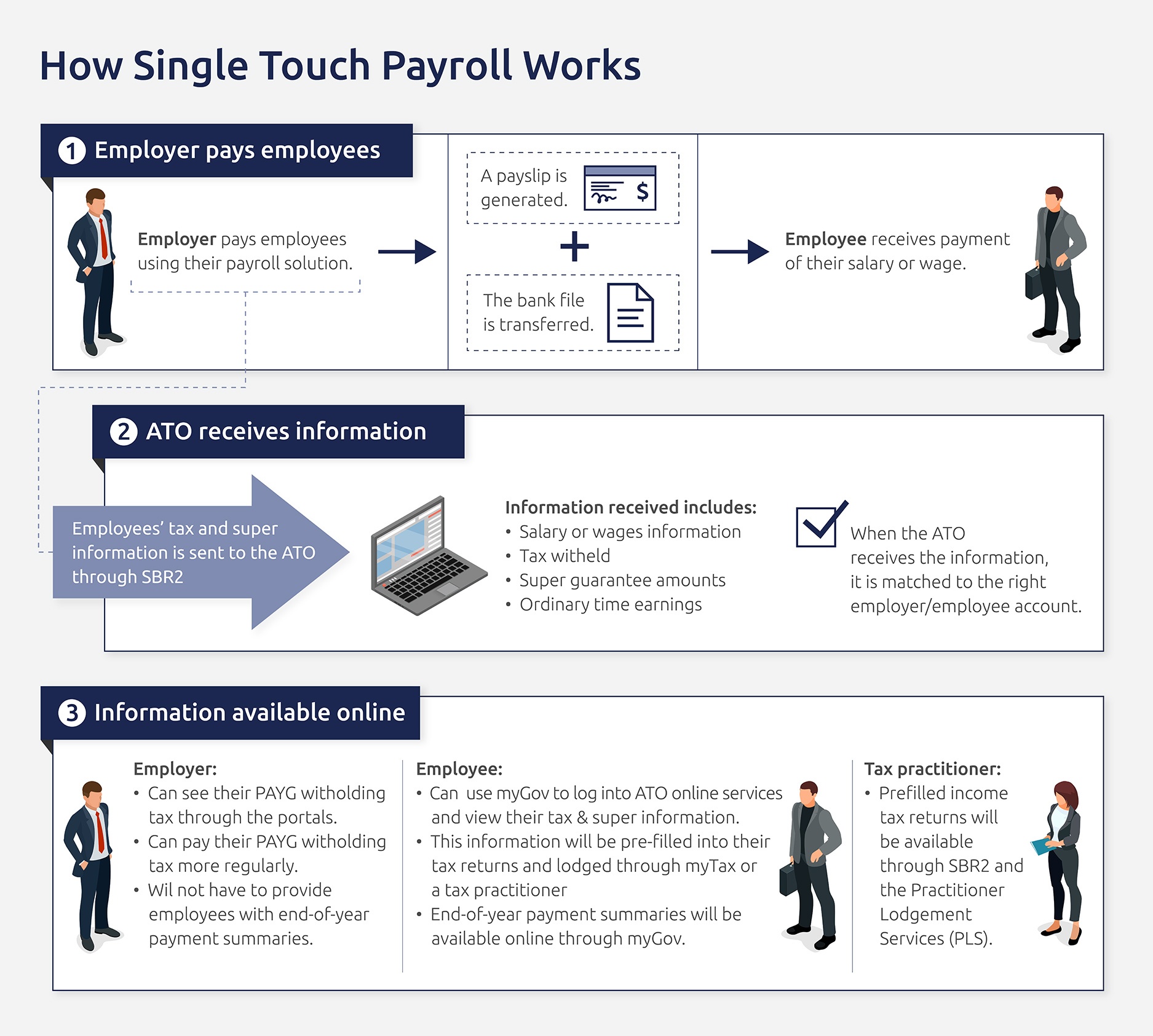

Single Touch Payroll (STP) is an initiative introduced by the Australian Tax Office (ATO) to provide real-time visibility over the accuracy and timeliness of organisations' payroll processes. STP is designed to streamline the administration of employee payroll, tax and superannuation reporting obligations for employers.

We have received questions from our SAP customers in Australia asking what this means to them. Based on those questions, we have compiled this TOP TEN LIST of the key items Australian employers with SAP for core Human Capital Management (HCM) need to know:

| 1. |

Employers with 20 or more employees will need to start reporting through Single Touch Payroll (STP) from 1 July 2018. Valid SAP supported customers of AU Payroll have until 30 April 2019 or the first pay date after this date.

|

| 2. |

Employers will need to report payments such as salaries and wages, Pay As You Go (PAYG) withholding and super information to the ATO, directly from their payroll solution, at the same time that they pay their employees.

|

| 3. |

The production of Employee payment summaries will no longer be required. However, since reporting to the ATO becomes part of every pay cycle, there is a big emphasis on data and process quality.

|

| 4. |

SAP’s solution delivery of Single Touch Payroll (STP) is delayed until 11 October 2018.

|

| 5. |

The ATO has provided Amended Deferral specific letters for SAP On-Premise customers that can be downloaded from SAP Core HR Capabilities in SAP ERP website: Asia Pacific and Japan.

|

| 6. |

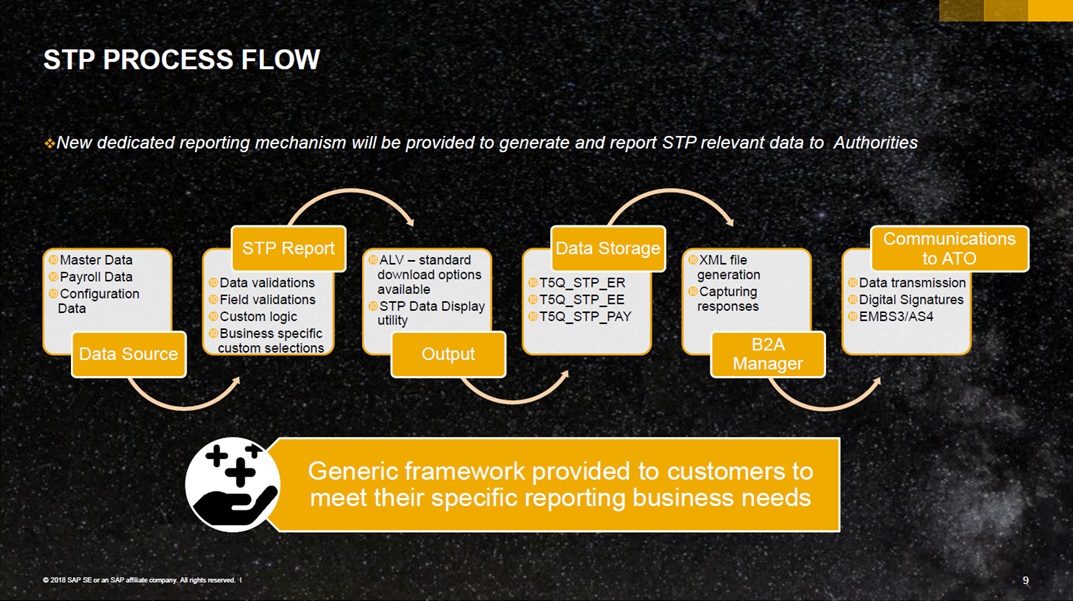

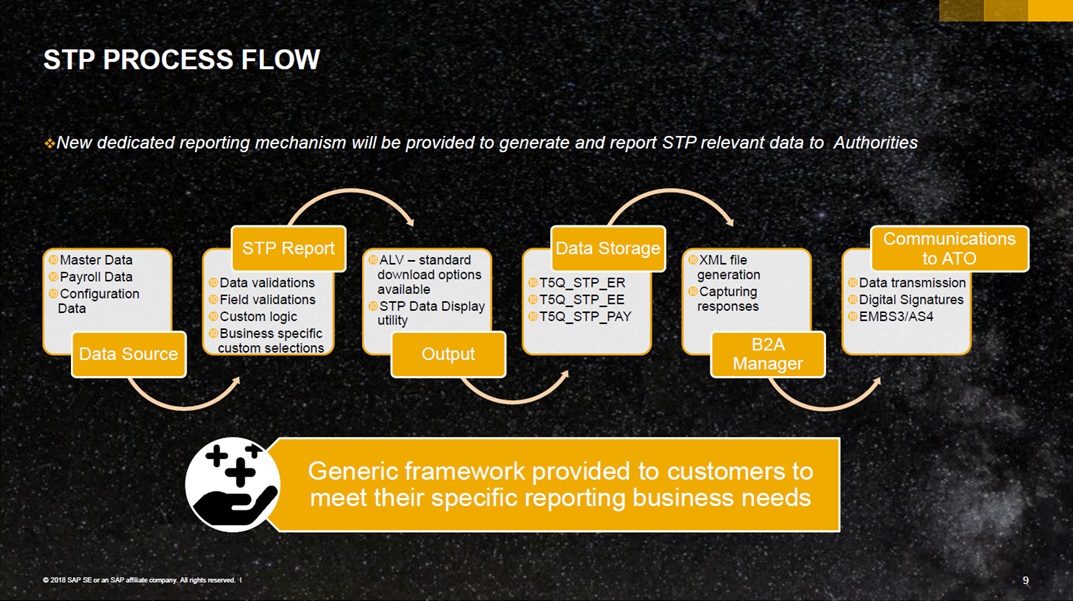

The solution offered by SAP will contain two parts.The first contains the ECC changes and the second includes the SAP Cloud Platform Integration (SCPI) messaging component for which a license is required.

|

| 7. |

For a business which decides not to use the standard SAP solution, SAP can only provide the ALE STP report. This is for customers not wishing to use the SCPI part of the solution; they are required to implement the first (ECC) part of the solution which is standard.

|

| 8. |

The EPI-USE Labs Query Manager solution can assist you in validating and reconciling your data, learn more here.

|

| 9. |

Readiness is key to successful implementation; including readiness of payroll configuration, year-to-date totals and processes.

|

|

10.

|

There are a few SAP Notes to keep an eye on: SAP’s General Note on STP 206858, Protected Earnings Amount (PEA) Rates for 2018 258322, Minimum HRSP levels for implementing 2017/2018 EOY changes 2591815, Change in taxation of marginally taxed termination payments 2599851 and 2631401 for concurrent employment AU and additional bug fixes.

|

You can access SAP’s STP Solution Overview presentation deck and Vikas Pandey’s webinar recording playback from here in the section titled EOY 2017/18 and STP Solution Overview (May 2018).

Photo Source SAP

In our next blog, we will discuss how you can leverage EPI-USE Labs’ Query Manager and Document Builder to assist in your STP.

Danielle Larocca

With over 20 years in SAP Human Capital Management, Danielle is a recognized leader in HR technology. She holds the distinguished roles of SAP Mentor and SuccessFactors Confidant, and serves as HCM Chairperson for ASUG (America's SAP User Group). Danielle is a sought-after speaker at international conferences, sharing insights on HR tech trends. She has authored four best-selling books on SAP and holds certifications in both SAP and SuccessFactors technologies.